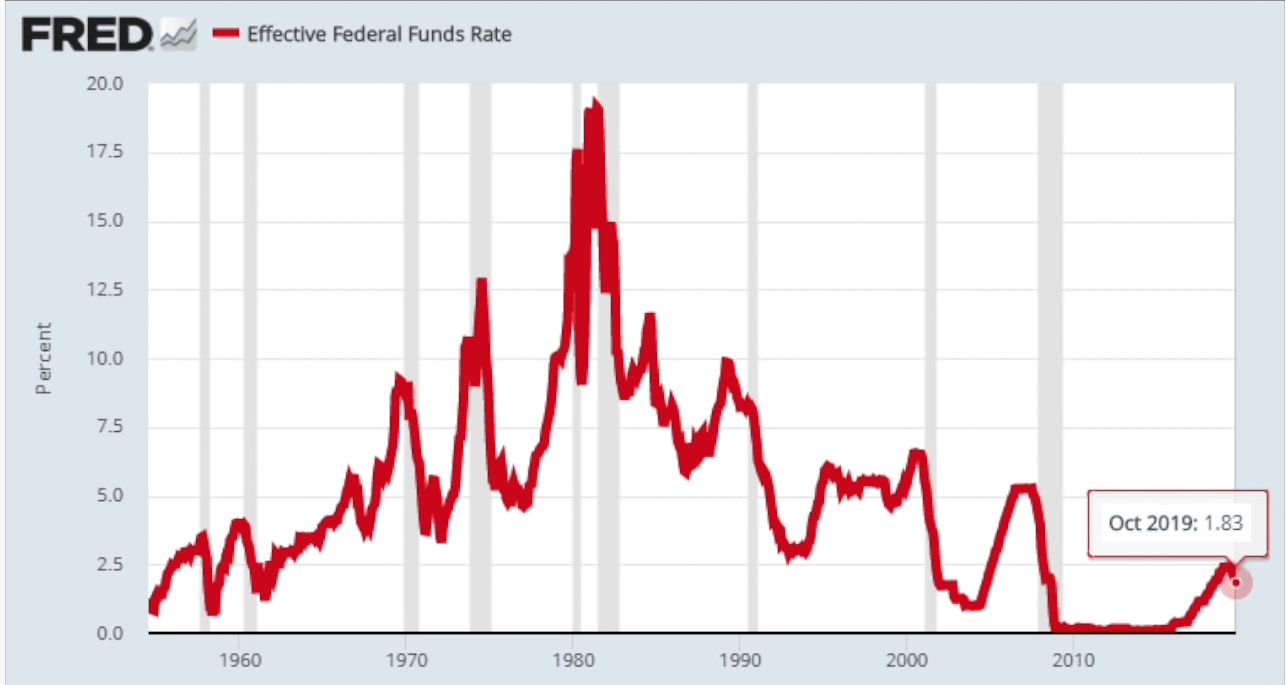

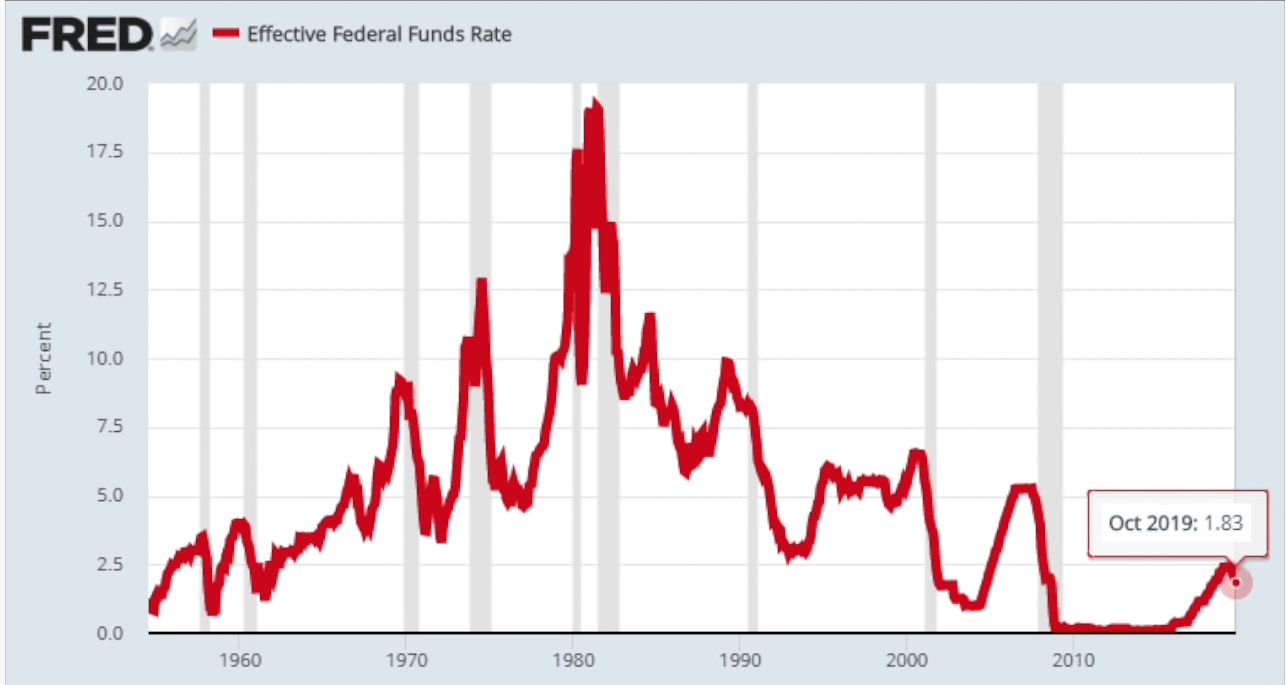

Interest Rate - Chart: The Downward Spiral in Interest Rates Globally - Interest rates are the cost of borrowing money.

Interest Rate - Chart: The Downward Spiral in Interest Rates Globally - Interest rates are the cost of borrowing money.. It impacts the economy by controlling the money supply. Calculating interest rates is not only easy, it can save you a lot of money when making investment convert the interest rate to a percentage by multiplying it by 100. An interest rate is a calculation convention that allows us to summaries a string of cash flows that will occur at different points in time with a single percentage figure. The effective interest rate isn't just another number in the sea of numerals when getting a loan. Interest rates also show the return received on saving money in the bank or from an asset like a government bond.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed (called the principal sum). The policy interest rate is an interest rate that the monetary authority (i.e. It impacts the economy by controlling the money supply. The interest rate is the percent of principal charged by the lender for the use of its money. Interest rates give information on the cost of money in the economy.

Visit the link below to watch it for free

Click here to watch it now : https://bit.ly/2NpXrtG

An interest rate refers to the amount charged by a lender to a borrower for any form of debtcurrent debton a balance sheet, current debt is debts due to be paid within one year (12 months) or less. Lowering interest rates can give the. Interest rates give information on the cost of money in the economy. Calculating interest rates is not only easy, it can save you a lot of money when making investment convert the interest rate to a percentage by multiplying it by 100. Add interest rate to one of your lists below, or create a new one. The interest percent that a bank or other financial company charges you when you borrow money…. An interest rate formula is used to calculate the repayment amounts for loans and interest over in simple words, the interest rate is the rate at which the lender charges the amount over principle. Individuals borrow money to purchase homes, fund projects, launch or fund businesses.

What is the effective interest rate in a loan?

Overall, you can think of the interest rate as a way to gauge your monthly costs, whereas the apr gives you a. As such, they are invaluable in helping to provide an overall indication of the economy. When are interest rates applied? The policy interest rate is an interest rate that the monetary authority (i.e. The central bank) sets in order to influence the evolution of the main monetary variables in the economy (e.g. The interest rate is the percent of principal charged by the lender for the use of its money. Rates are mainly determined by the price charged by the lender, the risk from the borrower and the fall in the capital. Interest rates give information on the cost of money in the economy. Interest rate is a rent on money to compensate the lender for foregoing other useful investments suppose the principal amount of a loan is $200, the interest rate is 5%, and transaction costs and. The interest rate is the percentage of the loan amount that is charged for borrowing money. Interest rate definition, the amount that a lender charges a borrower for taking out a loan, typically expressed as an annual percentage of the loan balance. An interest rate is the amount a borrower pays a lender to use the lender's capital. An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed (called the principal sum).

The central bank) sets in order to influence the evolution of the main monetary variables in the economy (e.g. When you borrow money for anything from a mortgage to a credit card, the amount you pay back is dictated by the interest rate, plus any additional fees. The interest rate is the percent of principal charged by the lender for the use of its money. Trade across the european curve. We can consider this the base fee.

Visit the link below to watch it for free

Click here to watch it now : https://bit.ly/2NpXrtG

The table has current values for interest rate, previous releases, historical highs and record lows, release frequency, reported unit. An interest rate increase in one currency combined with the interest rate decrease of the other currency is the perfect equation for sharp swings! The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency. When are interest rates applied? The effective interest rate isn't just another number in the sea of numerals when getting a loan. The interest rates on prime credits in the late 1970s and early 1980s were far higher than had been reasons for interest rate change. What is the effective interest rate in a loan? This page provides values for interest rate reported in several countries.

Add interest rate to one of your lists below, or create a new one.

Individuals borrow money to purchase homes, fund projects, launch or fund businesses. An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed (called the principal sum). As such, they are invaluable in helping to provide an overall indication of the economy. An interest rate formula is used to calculate the repayment amounts for loans and interest over in simple words, the interest rate is the rate at which the lender charges the amount over principle. It impacts the economy by controlling the money supply. The real interest rate is found by adjusting a standard interest rate so that the effects of inflation are not present. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency. Interest rates are the cost of borrowing money. Overall, you can think of the interest rate as a way to gauge your monthly costs, whereas the apr gives you a. A decimal like.34 doesn't mean. Lowering interest rates can give the. We can consider this the base fee. In this scene, i explain the basics of interest rates, how they work, and how the federal reserve is able to change them through means of the money supply.

An interest rate formula is used to calculate the repayment amounts for loans and interest over in simple words, the interest rate is the rate at which the lender charges the amount over principle. The effective interest rate isn't just another number in the sea of numerals when getting a loan. The policy interest rate is an interest rate that the monetary authority (i.e. Interest rates are the cost of borrowing money. We can consider this the base fee.

Visit the link below to watch it for free

Click here to watch it now : https://bit.ly/2NpXrtG

The interest rate is determined by prevailing rates and the borrower's credit score. It impacts the economy by controlling the money supply. The real interest rate is found by adjusting a standard interest rate so that the effects of inflation are not present. The effective interest rate isn't just another number in the sea of numerals when getting a loan. An interest rate is a calculation convention that allows us to summaries a string of cash flows that will occur at different points in time with a single percentage figure. A decimal like.34 doesn't mean. Interest rates apply to most lending or borrowing transactions. By convention, interest rates are.

The interest rate is the percentage of the loan amount that is charged for borrowing money.

We can consider this the base fee. This page provides values for interest rate reported in several countries. As such, they are invaluable in helping to provide an overall indication of the economy. The interest rate is the percentage of the loan amount that is charged for borrowing money. The interest percent that a bank or other financial company charges you when you borrow money…. The interest rates on prime credits in the late 1970s and early 1980s were far higher than had been reasons for interest rate change. It is very important when comparing loan quotes since it directly affects. Trade across the european curve. Different rates are distinguished by the period. Interest rate definition, the amount that a lender charges a borrower for taking out a loan, typically expressed as an annual percentage of the loan balance. Lowering interest rates can give the. Add interest rate to one of your lists below, or create a new one. The interest rate is the percent of principal charged by the lender for the use of its money.

Comments

Post a Comment